Disclaimer:- If you want the direct conclusion, you can jump directly to the Conclusion section below in the answer. No promotion included. Everything is for knowledge purposes, do your analysis or ask your financial advisor before making any decision.

Hey there!

I hope you’re doing great.

I’m writing this answer on the 17th of February, 2024. The day is Friday and the Time is 4:39 pm. Markets are closed today as it’s a weekend and now I’m going to answer the question.

Firstly, let’s look at the basics of PAYTM stock:-

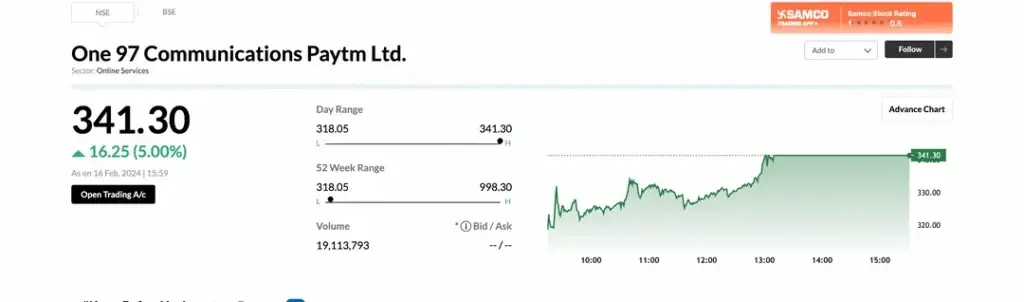

As of Friday’s market, the CMP of the stock is 341.30 INR, stock provided a 5% upper circuit on the same day after consecutive lower circuits. It is trading very near to its lifetime low. The lifetime high of the stock is INR 1955 (on its first trading day/IPO launch day), and the 52-week high is 998.30.

Basic Quantitative Ratios of Paytm:-

The Market Capitalization of the company is INR 21000 crore, the P/E ratio of the company is not available as it is a loss-making company. The book value is just INR 196 which means that this stock still is expensive according to the theory. Other ratios you can check from the above image, if you have any doubt regarding any, please ask in the comment section.

Especially take a look at the ROE, its negative 13.9%, which is not at all good. It’s a very important ratio and it is in bad condition over here.

Let’s move on to some Financials of the company now:-

- Revenue:-

The Revenue of the company is looking good here, in FY 2022, the company made a profit of INR 3892 crore while in FY 2023 it increased and reached over INR 6000 crore as seen in the picture which is a good growth for the company.

- Net Profit:-

Here is the picture of the company’s Net Profit which looks very bad to me. In FY 2022, the company made a huge loss of around INR 2000 crore, which decreased in FY 2023 by around INR 500 crore and made a net loss of INR 1855 crore.

- Per Share Ratios:-

You can see the per share ratios in the above picture where we see a slight growth in every ratio from FY 2022 to FY 2023 which is still negative but improving, and it doesn’t mean that we have to think its a good company and doing good, yeah they did well in last FY but it is still in negative state which is not good at all, especially for me.

- Margin Ratios:-

All the profit margins of the company are in a negative state. Now you ask me what are margins and why are they so important. Margins are considered one of the most important ratios in the Quantitative analysis.

Margins mean how much a company earns for INR 100 spend how much the company earns, for example, Company A earns INR 10 for a spend of INR 100, so the margin here would be 10%. Now they are performed on different levels so they have different types too.

Now if you see the case of Paytm, they lose roughly INR 30 for a spend on INR 100 in operations. You got the point, right?

- Shareholding:-

The biggest flaw in the shareholding pattern here is that the Promotors don’t own 1% of the holding in this company, a lot of huge organizations don’t have promotors invested in them like a stock named ITC, but they sold their holdings over a very huge period, not in the initial stages.

Below are the holdings of Vijay Shekhar Sharma as a Non-institutions but not as a promotor of the company. I didn’t even see the name ONE97 Communication in the whole shareholding pattern, there might be some shell company in foreign who invests indirectly on behalf of the organization. It’s a very common activity for such companies and show themselves as FII with their own money. (It’s just a thought of mine, imaginary, nothing else)

Now if we talk about FIIs, they have reduced their holding gradually over the last 4-5 quarters and DII are increasing their holding in very small quantities.

The Public owns 30% of holdings and they also decreased over a few quarters.

This was the Quantitive Fundamental Analysis of the PAYTM, now we’ll look at some TECHNICAL CHARTS AND PATTERNS:-

- Weekly Paytm Chart:-

Why do I use the weekly chart of PAYTM over here?

Because we’re looking for a longer period, here you can see the major support zone on the below side of the stock, the range is around INR 530-420, which was broken drastically in the last 3 weeks, for a few days the stock tried to respect the support zone, and formed an inverted hammer but failed the next week.

According to the chart patterns, you can picture it as a falling knife with a lot of corporate governance issues, that you might have heard in the news or social media. I will not cover those issues as everyone knows about them and can see everything over YouTube or News Channel.

Conclusion:-

- According to my analysis, which was a Techno-Funda analysis, this stock is not at all looking positive from any point of view. The company is loss-making and has not made any recovery in the last few years.

- They continuously got warnings from RBI and other government bodies like NHAI. They did a lot of wrong things in the past and never recovered from anything or any promise that they made to the government.

- They committed fraud by opening a lot of fake bank accounts, even 100 and 1000s of accounts over one PAN card for different customers and they all are functional and have a lot more issues, the list won’t be over I guess.

- According to the technical analysis, I concluded that it’s a falling knife and if we tried to catch it, we might get hurt and get a dent in my finances. All the support zones are already broken and the chances of recovery aren’t seeming near

- Other very positive undervalued and profitable stocks are available in the market, some of them are even market leaders and good midcap stocks too, why shouldn’t I invest there and avoid all the HEADACHE?

You got the point right, Thanks for reading.

If you have any doubts, please use the comment section and I’ll reply for sure.

Source: Moneycontrol, Screener, Tradingview

Aditya Gaur is the founder of FinanceXaditya and a seasoned stock market investor with over 7 years of experience. Known for building India’s first public dividend growth portfolio showcase, he shares time-tested strategies and real insights that help everyday investors create wealth. With 50,000+ followers across social media, Aditya has become a trusted voice in personal finance and long-term investing.